Post Office Schemes: In today’s time, everyone understands the need for savings. People want to invest their hard-earned money in the right place, where they get security and good returns. Many people are afraid of the risk of the stock market, and the falling interest rates of banks have become a cause of concern. In such a situation, Post Office Saving Schemes emerge as a reliable and safe option, which not only keeps your money safe but also helps in increasing it.

These schemes recognized by the government keep your capital completely safe and also give great returns. Their biggest feature is that you can start investing in them with a very small amount and gradually create a big fund. The biggest advantage of these schemes is that they are not affected by the fluctuations of the market, that is, the risk in investment is almost zero. This is the reason why these schemes prove to be very beneficial for every section – be it the elderly, women, children, or working people.

Senior Citizen Savings Scheme

If you want a comfortable and financially secure life after your retirement, Senior Citizen Savings Scheme (SCSS) is an excellent option. This scheme is specially designed for senior citizens to provide them with regular income and complete protection on their invested capital.

Interest Rate:-This scheme offers attractive interest of up to 7.4% (this rate may change as per government announcements).

Tax Benefits:-It also offers the benefit of tax exemption under Section 80C of the Income Tax Act, which reduces your tax liability.

Accessibility:-The investment limit and period have also been made very simple, making it even easier for senior citizens to invest in it.

This scheme helps ensure financial stability and a comfortable life after retirement.

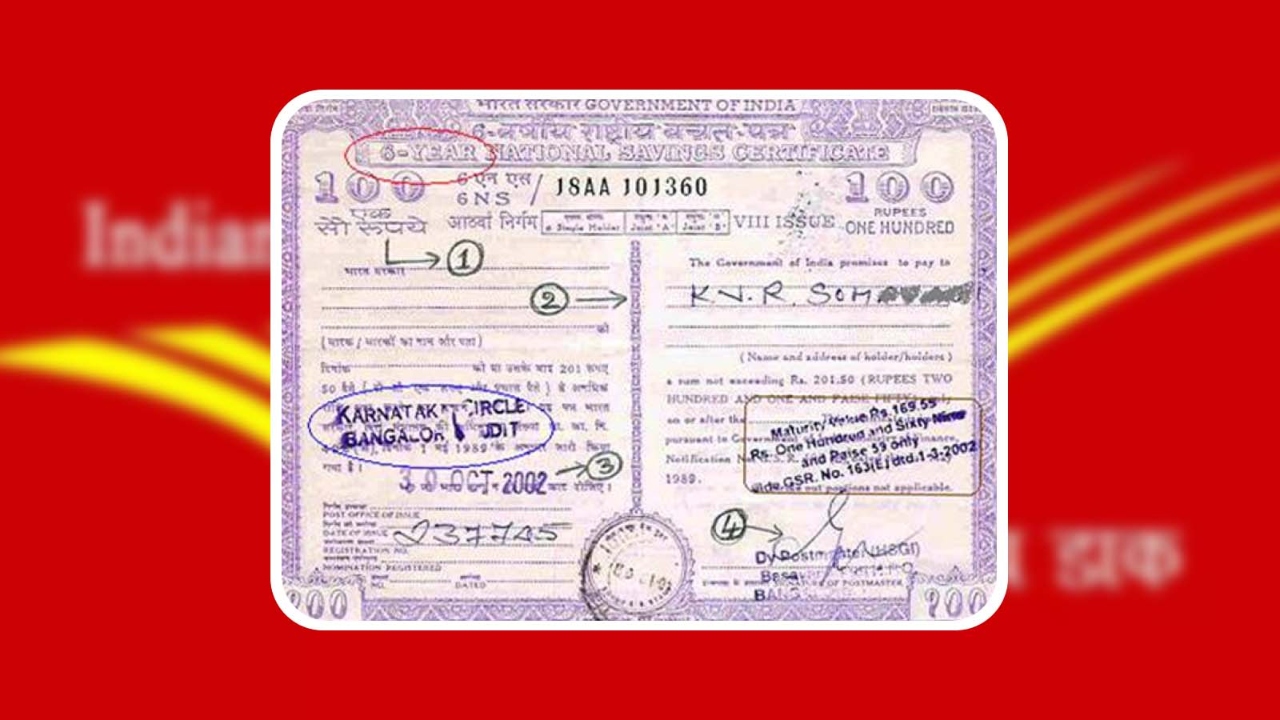

National Savings Certificate

If you are looking for an investment that is not only safe but also helps you save tax, the National Savings Certificate (NSC) is an excellent option. It is a strong government-backed scheme, which means your money is completely safe in it and will not sink.

Investment period:- This scheme is usually for five years.

Interest rate:- You get up to 7.7% interest on it (this rate may be revised from time to time).

Tax benefits:- The amount invested in it is eligible for income tax exemption under section 80C, which helps you save your tax.

Maturity guarantee:- The amount received on maturity is fully guaranteed, which gives peace of mind to investors.

NSC is an ideal option for those who want both guaranteed returns and tax benefits with low risk.

Sukanya Samriddhi Yojana

If you want to secure the bright future of your beloved daughters, then Sukanya Samriddhi Yojana (SSY) is the best and most reliable scheme. This scheme is specially designed for girls, which provides strong financial support in meeting big expenses like their higher education and marriage.

Higher interest rate:- This scheme offers a higher interest rate than other small savings schemes (which is currently 8.2%), making your money grow faster.

Triple tax benefit:- It falls under the EEE (Exempt-Exempt-Exempt) category, i.e. there is no tax on the amount invested, interest earned, and the amount received on maturity. Tax exemption is also available under section 80C.

Long-term savings:- This is a great long-term savings option, through which you can create enough funds for your daughter’s big expenses by making gradual deposits over the years.

Government guarantee:- Being backed by the government, it gives guaranteed returns on investment, making your investment completely safe.

This scheme is a great and emotional way to empower daughters financially and give them a strong future.

Post Office Monthly Income Scheme (POMIS)

If you want a fixed income every month, then Post Office Monthly Income Scheme (POMIS) is a very good option. This scheme is best for those who have invested their capital and want regular income from it, especially retired persons or housewives.

Monthly Interest:- In this, money is received every month as interest on the invested capital, which can meet your daily needs.

Risk-Free:- It is a risk-free scheme as it is backed by the Government of India, so there is no risk to your investment.

Stability:- The fluctuations of the stock market do not affect it, which keeps your income stable and gives you mental peace.